مكتب رقم 12 برج بنك التنمية - حي الغدير، الرياض

Stop moving between different systems to manage financial operations! As well as moving between accountants! Ahad Network system is designed to facilitate the process of managing tax compliance for non-specialists who wish to manage their operations on their own. It facilitates access and interaction with financial and tax advisors for those who wish to delegate others to do the task on their behalf!

Designed for non-financial professionals to facilitate the process of managing finances easily, quickly, and without the need to move between systems!

In reviewing financial operations and issuing reports and tax returns, there are alternative options and systems!

The rate of savings in traditional tax administration expenses for individuals and small and medium-sized companies!

The system automatically checks every transaction entered into the system to verify the correct classification and tax treatment!

The system is based on rules built according to trade and tax systems, Supported by suggested directions and corrections!

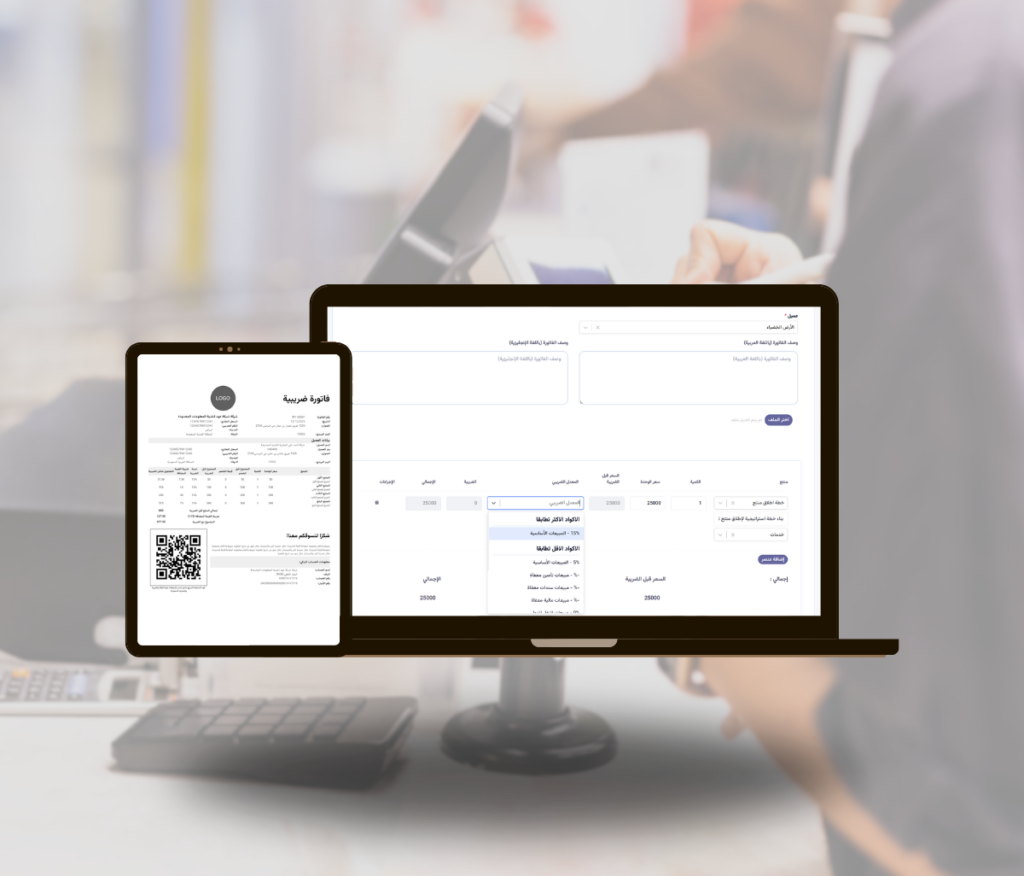

Issue your tax invoices that comply with the requirements of the Saudi Zakat, Tax and Customs Authority easily and quickly. You can upload them or send them directly to your customers through the system.

Let the system help you choose the correct tax classification for your financial transactions, Or ask him to review the classifications to identify errors and suggest the required corrections.

Easily issue your tax return and save your transactions with attachments that you may need in the future to review or answer any regulatory inquiries.

The system uses dozens of financial and tax advisors from all specialties. You can contact them to request services or inquire when needed.

Raise your level of professionalism and control your revenues by using the electronic billing system. You can create invoices and send them to your customers through the system. Eliminate paperwork and errors, This system is compatible with Saudi trade and tax systems. You can activate the tax invoices option once you register for VAT.

1

Add the customer, products and their price. Based on this information, the system will suggest to you the tax rate that suits it. Then you can save the invoice as a draft.

2

After saving the invoice as a draft, you can download the draft to verify the accuracy of its data or share it with the customer to confirm. The system will then issue the invoice according to the serial number.

3

After issuing the invoice, you will be able to download it in PDF format to send it to the customer in the most appropriate way. You can also use the system to send the invoice directly to the customer.

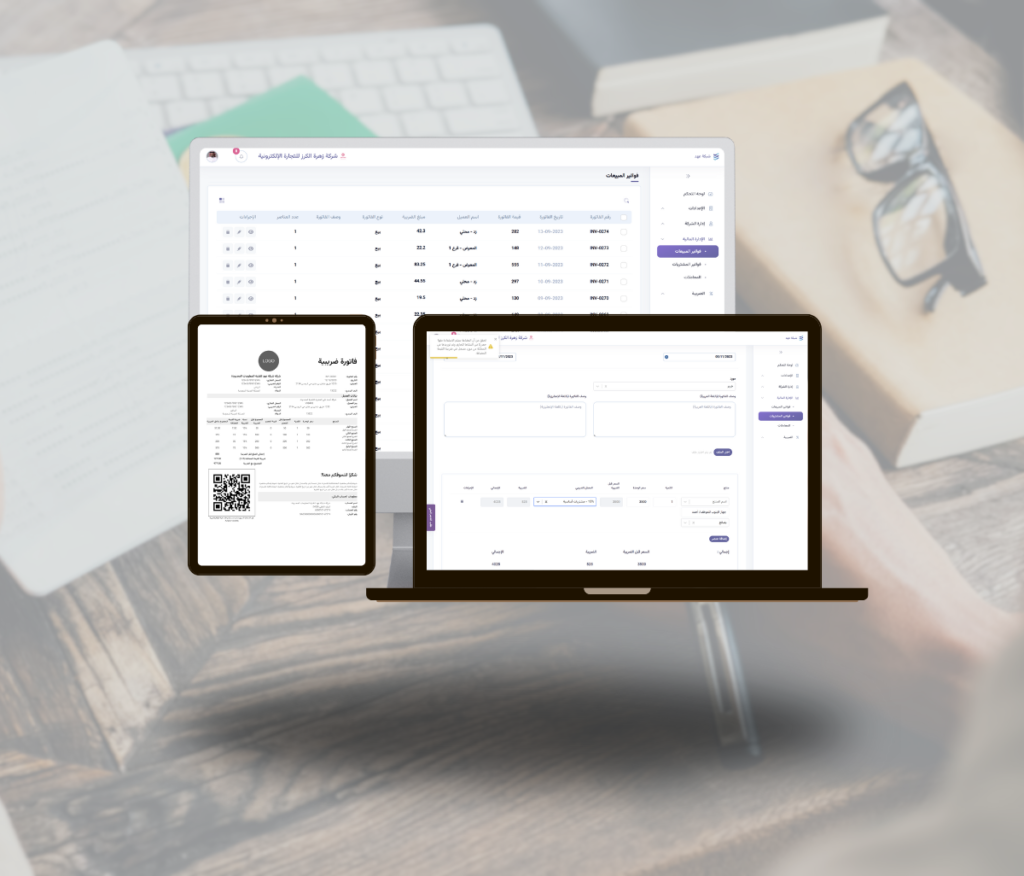

An ideal system for individuals and owners of small and medium businesses. Easy to use and does not require financial or accounting experience. It enables you to track and control your expenses. If you are registered for VAT, it will help you recover your paid taxes accurately and while maintaining your compliance. The system is cloud based, so you will be able to work on your company or access information from any device at any time. Say goodbye to the stress of accounting and start enjoying our easy and hassle-free solution today!

1

The system provides several options for adding processes to the system. manual entry, Uploading using spreadsheet programs or technical linking.

2

To check operations, The system will (optionally) ask you to add a classification of transactions to provide you with feedback regarding the correctness of tax treatment.

3

Then, You will have to review the system notes (if any) about the completeness of the information and the correctness of the tax treatment, And correct any errors that the system alerted you to.

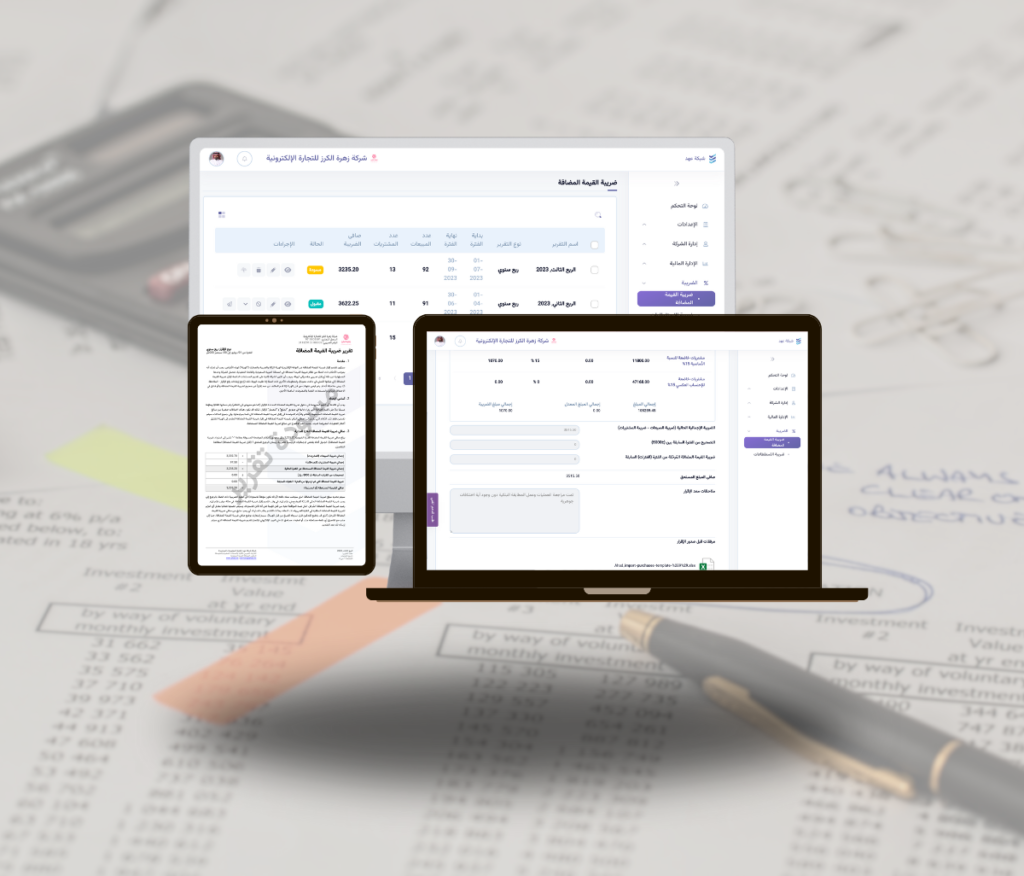

The tax returns product facilitates compliance with tax laws and regulations in Saudi Arabia for owners of small and medium enterprises. Through an easy-to-use platform designed for non-financial professionals, You will receive reminders of the deadlines for preparing returns. It helps you in preparing and reviewing the declaration. All attachments and supporting documents will be saved for you to refer to when needed. Because it depends on technology, all of this will happen within a few moments.

1

Select the period for which you wish to issue the tax return. The system will fetch all relevant processes, You will be able to exclude or add operations as needed.

2

Once the declaration is generated, the system will conduct a tax examination on all transactions. It will notify you of any incorrect operation or operation that requires correction. With instructions on how to correct.

3

Issue the declaration and download the reports that the system will generate automatically. These reports can be used when submitting your declaration to the Zakat, Tax and Customs Authority.

Whether you feel unsure about your ability to manage your tax affairs, Or you have a condition that you’re not sure how to treat, The tax consulting system will give you the confidence you need for peace of mind. We have a wide base of specialized and experienced consultants, They will be available to answer your inquiries or manage your operations if you wish.

1

Submit a service request including the problem you are facing. We will study the case and identify consultants who are candidates to provide the service.

2

We will send you the names of the service providers so you can choose the most suitable for you. With your consent, The service provider will be able to access data related to the case.

3

After you confirm receipt of the service, The case will be closed. And revoke the access permissions granted to the service provider.